Of the inventory. If this metric is too high it means your buying too much inventory.

This means that the inventory is valued at current replacement cost or historical cost whichever is less.

The money tied up in inventory best represents. The money tied up in inventory best represents a An opportunity cost b A liquid from ISYS 4223 at University of Arkansas. The money tied up in inventory best represents AAn opportunity cost. DA high risk for loss.

EA material planning strategy. Their cash is tied up in inventory as well as receivables and that has a significant effect on cash flow and consequently a significant effect on how much they can use for capital expenditures. Inventory turnover is important because a company often has a significant amount of money tied up in its inventory.

If the items in inventory do not get sold the companys money will not become available to pay its employees suppliers lenders etc. It is also possible that a companys inventory will become less in demand perhaps become. Since DSI indicates the duration of time a companys cash is tied up in its inventory a smaller value of DSI is preferred.

Capital costs can be viewed as the _____ associated with the money tied up in inventory. Obsolescence is likely a bigger problem for which type of product. Of the inventory.

Inventory is good in the right _____. The cost associated with the money tied up in inventory and the cost associated with maintaining it in storage usually expresses as a percentage of items value define and explain the four major components of inventory carrying costs explain how each is calculated you should be able to calculate a companys inventory carrying cost as in the example. Many translated example sentences containing money tied up inventory French-English dictionary and search engine for French translations.

The planning table is best defined as A spreadsheet-like tool used to complete the tasks in SOPq Given the information below calculate disaggregated quantities for. That said slow-moving inventory ties up your cash in idle inventory. It creates a negative impact on profitability and cash flow.

If you have investors in your company it lowers their return on equity. This metric measures the average number of days it takes you to sell your entire inventory on hand based on the cost of goods sold. If this metric is too high it means your buying too much inventory.

Lower is better indicating good inventory management but if it is too low beware. The cost of inventory is not solely determined by the direct expenses associated with storing managing and maintaining the goods but also by the opportunity costs that arise when money is tied up. You still have 5608 tied up in raw materials inventory.

Now the Sales If you priced your product correctly ReciPals costing tool can help with that you should be selling your spice rub for about 286unit generating sales of 6864 and a gross profit margin of 4464 6864 sales - 2400 COGS. Many companies state that in their annual reports the inventory is shown at the lower of its cost or market value. This means that the inventory is valued at current replacement cost or historical cost whichever is less.

Goods in transit between the buyer and seller belong to. Many retailers have their cash tied up in inventory which is why the 1 thing that you can do to improve cash flow is to ensure that youre stocking the right products and selling them at a healthy profit. If you do end up with excess stock take immediate steps to liquate.

Here are some tips for doing all the above. Holding unsold inventory is costly because money is tied up in an idle resource with no income until the inventory is sold. It is costly to store inventory especially when it requires special.

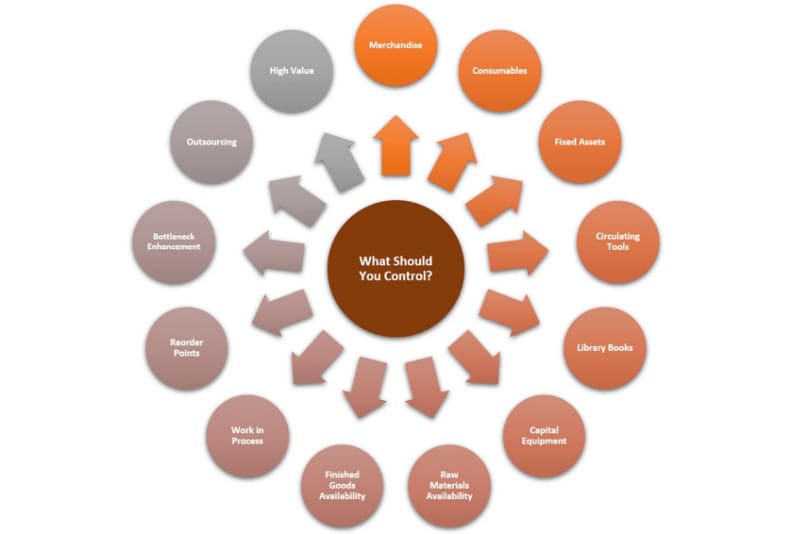

Accounting techniques are used to manage inventory and financial matters how much money a company has tied up within inventory of produced goods raw materials parts components etc. These techniques manage assumptions of cost flows related to inventory and stock repurchases. Inventory levels are reduced to save on costs decrease on lost profit and free up money for other operations in your business.

Think of it this way if youre trying to make big money you would never invest everything into one source. You need to diversify your portfolio to succeed. The same principle is applied to inventory reduction.